Top Loyalty Programs in Nigeria: Trends & Best Practices

Customer loyalty is becoming a cornerstone of business success in Nigeria. From retail and banking to e-commerce and hospitality, companies are realizing that retaining customers is as important as acquiring them.

The loyalty market is growing rapidly, with projections showing it will reach US$628.5 million in 2024 and expand to US$893.2 million by 2028.

In this article, we’ll explore the trends shaping loyalty programs in Nigeria and their impact on customer experience, highlight best practices for businesses, and showcase the best loyalty programs currently engaging Nigerian consumers.

Loyalty in Nigeria: a quick overview

The loyalty program landscape in Nigeria has transformed significantly in recent years, with businesses increasingly offering cash reward. Between 2019 and 2023, the industry recorded a CAGR of 12.4%, reflecting rising consumer demand for value and personalized experiences.

Key drivers of this customer loyalty growth include:

- Technological adoption: the rise of mobile apps and digital wallets.

- Changing consumer behavior: increasing demand for rewards, cashback, and savings.

- Regulatory changes: stricter data protection and consumer protection laws.

As competition intensifies, brands are using loyalty programs not just to retain customers, but to differentiate themselves in a crowded marketplace.

Key trends in Nigerian loyalty programs

The customer loyalty program landscape in Nigeria is driven by shifts in consumer expectations, digital adoption, and competitive market dynamics.

Businesses across industries, from banks to retailers and e-commerce giants, are leveraging loyalty initiatives to retain customers, increase engagement, and encourage repeat business to maximize lifetime value. Here are the key trends shaping the market today:

1. Increasing popularity across sectors

Loyalty programs are no longer limited to airlines or supermarkets, offering customers exclusive access to a wider array of service. In Nigeria, they are spreading across retail, financial services, hospitality, and especially e-commerce, as businesses recognize the value of long-term customer relationships.

Retailers use discounts and loyalty points to encourage repeat store visits, banks offer reward schemes to promote digital banking adoption. E-commerce platforms like Jumia are leading with digital-first loyalty initiatives tied to payments and shopping.

This surge reflects Nigerian consumers’ growing demand for instant rewards and value-added services and tangible benefits from the brands they interact with.

2. Diverse program structures

Nigerian loyalty programs come in different forms, catering to varying consumer behaviors and preferences:

- Points-based systems: Customers earn and redeem points for future purchases, encouraging repeat transactions.

- Tiered rewards: Programs with Silver, Gold, and Platinum levels incentivize higher spending by offering better perks as customers climb the loyalty ladder.

- Cashback models: Consumers receive instant financial benefits, a format gaining strong traction as price sensitivity increases.

This diversity allows companies to segment their audiences and design rewards that appeal to different income levels and spending patterns.

3. Technological integration and mobile-first design

Technology is transforming Nigeria’s loyalty programs. With smartphone penetration and mobile wallet usage on the rise, consumers increasingly expect loyalty programs to be app-based, allowing them to track rewards in real-time, integrated with digital payments, enabling seamless earning and redemption, and omnichannel.

Brands that integrate customer loyalty with mobile apps, USSD codes, or digital wallets are seeing higher adoption rates because they make rewards simple, fast, and accessible.

4. Focus on personalization through data analytics

As competition grows, personalization is key for both customer acquisition and retention, because it lets brands gain valuable insights into their loyal customers.

Nigerian businesses are investing in data-driven loyalty strategies, analyzing purchase behavior and preferences to deliver personalized offers and discounts, segment customers into meaningful groups (e.g., frequent shoppers, high spenders), and communicate with relevance via SMS, email, or app notifications.

By tailoring loyalty programs to individual needs, companies create stronger emotional bonds, leading to higher retention and increased spending.

5. Cashback rewards programs

One of the most significant trends in Nigeria loyalty today is the rapid rise of cashback programs. Unlike points-based systems that delay gratification, cashback offers instant value.

Key reasons for their popularity include the immediate financial rewards customers see after purchase, a higher perceived value in competitive markets like retail and e-commerce, and the integration with fintech platforms and digital wallets, which makes redemption seamless.

As Nigerian consumers become increasingly value-conscious, cashback loyalty programs are expected to dominate the landscape over the next five years.

Best practices for loyalty programs in Nigeria

Designing a successful loyalty program in Nigeria means balancing consumer expectations, regulatory compliance, and software technology adoption. Here are five best practices to follow, and how White Label Loyalty’s new products help you gain an edge in brand loyalty.

1. Understand consumer preferences

Nigerian consumers want tangible rewards such as cashback, vouchers, and discounts. Programs that fail to deliver visible value risk low adoption.

With Activate, brands can easily launch custom-branded apps or microsites that deliver instant, visible rewards customers care about.

2. Technology for seamless experiences

Mobile-first, digital integration is essential in Nigeria, where most loyalty engagement happens via smartphones and wallets.

Dynamo, White Label Loyalty’s headless API loyalty engine, plugs directly into your existing stack. It captures interactions, automates rewards, and enables fully personalized loyalty flows, all without heavy dev resources.

3. Ensure compliance and build trust

Nigeria’s data protection and consumer rights laws are becoming stricter. Brands must ensure GDPR-level compliance and transparent reward structures.

Enterprise gives large organizations a secure, API-first platform with enterprise-grade encryption, fraud prevention, and consent management tools to guarantee compliance while scaling loyalty safely.

4. Communicate clearly and engage customers

Clarity drives trust and adoption. Terms, benefits, and rewards should be easy to understand and accessible across channels.

With Gravitate, brands can extend customer loyalty programs to social media platforms like Instagram, rewarding customers for actions such as follows, shares, and mentions, while capturing first-party data and maintaining GDPR compliance.

5. Optimize continuously with data insights

Loyalty programs must evolve with customer behavior and accommodate diverse preferences . Tracking engagement and refining campaigns is key to long-term retention.

Dynamo’s real-time analytics and Enterprise’s modular dashboards allow businesses to segment customers, test campaigns, and optimize strategies on the fly.

Top loyalty programs in Nigeria

Here are some of the leading customer loyalty programs that aim to offer customers engaging experiences:

1. NaijaCashToken

NaijaCashToken is a points-based program where customers earn tokens with every transaction. These tokens can be redeemed for rewards or used to enter draws with the potential of winning bigger prizes. The platform also enables businesses to analyze consumer behavior and create tailored offers based on spending habits.

Why it works: Nigerians value aspirational rewards as much as instant ones. The chance to win big prizes, combined with smaller guaranteed benefits, keeps customers consistently engaged while also motivating higher transaction volumes.

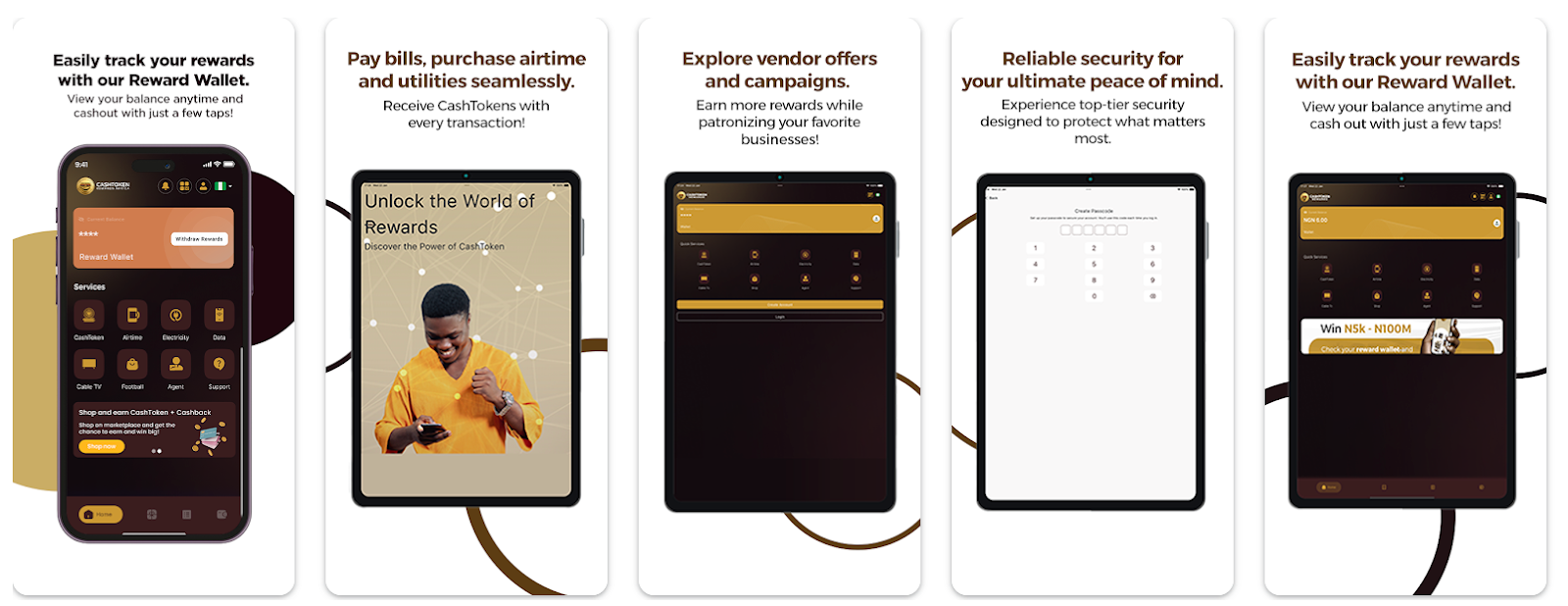

2. CashToken

CashToken is a pure cashback loyalty system that provides instant financial rewards directly tied to consumer purchases. Loyal customers receive cashback that they can either spend or save, offering tangible, immediate value. It is especially popular in the retail and e-commerce space, where it helps brands boost repeat purchases.

Why it works: In an economy where financial prudence is a priority, financial incentives and instant cashback resonate strongly with consumers. The transparency and immediacy of the reward reinforce trust and encourage frequent spending.

3. JumiaPay Loyalty Program

As part of Nigeria’s largest e-commerce platform, Jumia, the JumiaPay loyalty program lets customers earn points for every transaction completed via JumiaPay. These points can be redeemed for discounts and exclusive deals, creating a closed-loop ecosystem that connects payments, shopping, and rewards.

Why it works: By integrating rewards directly into the customer journey, JumiaPay strengthens loyalty within its own ecosystem. This model keeps customers returning to Jumia for both shopping and payments, increasing stickiness and long-term retention.

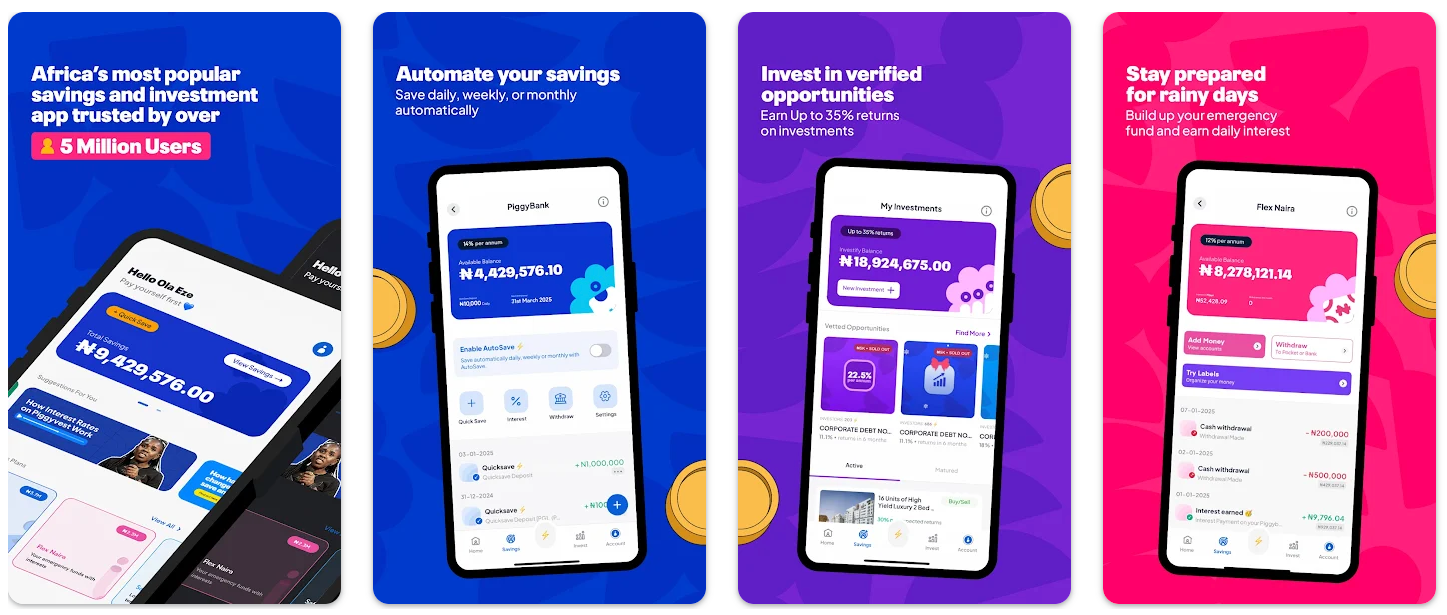

4. PiggyVest

PiggyVest is widely recognized as a digital savings and investment platform. In addition to helping users build disciplined saving habits, it offers rewards and bonuses for active users, referrals, and consistent deposits.

Why it works: PiggyVest taps into Nigeria’s rising millennial and Gen Z audience, who are highly digitally savvy but also value financial security. Its blend of savings, investment, and rewards encourages long-term engagement, making it more than just a transactional platform.

5. FoodCo Nigeria Loyalty Initiatives

FoodCo, a prominent Nigerian retail chain, has launched several customer-centric programs such as the “Festival of Savings.” These initiatives reward customers with discounts, seasonal promotions, and exclusive offers, driving foot traffic and brand preference.

Why it works: FoodCo leverages cultural and seasonal buying patterns by aligning promotions with festive periods. This timing increases relevance, boosts sales during peak seasons, and builds stronger emotional connections with customers.

Customer loyalty is just getting started in Nigeria

From cashback to multi-merchant ecosystems, customer loyalty programs in Nigeria are proving that customer engagement goes far beyond discounts. Nigerian consumers are savvy, value-driven, and ready to stick with brands that give them more than just a transaction.

The question is: is your brand ready to keep up?

If you’re looking to build a loyalty program that’s not just trendy, but truly transformative, our team of loyalty experts at White Label Loyalty is here to help. We design flexible, data-driven loyalty solutions that work across industries, from banking to retail to e-commerce.

👉 Get in touch with us today to explore how we can build a customer loyalty solution that keeps your customers coming back.

Recommended Posts

If you enjoyed this article, check out these relevant posts below.

Share this Article

Sara Rabolini

Content Marketing Executive

Sara is our Content Marketing Executive. She shares engaging and informative content, helping businesses stay up-to-date with the latest trends and best practices in loyalty...