Fighting Loyalty Fraud with AI and Machine Learning

Loyalty programs are powerful tools for building engagement and retention, but as they grow, so do opportunities for abuse. Fraudsters now use bots, automation, and synthetic identities to exploit even the most advanced systems.

From fake referrals to manipulated receipts, loyalty fraud has evolved into a data-driven threat costing brands billions and eroding customer trust. To protect loyalty and reputation, brands need technology that adapts as fast as fraud does, and that’s where AI and machine learning come in.

Why traditional fraud prevention isn’t enough

Modern fraudsters use increasingly sophisticated fraud tactics to exploit vulnerabilities, creating fraudulent accounts or manipulating reward points for personal gain. The scale of the problem is growing fast.

Industry reports suggest that loyalty fraud costs brands billions each year, while damaging customer trust and diluting the value of rewards. In an age where consumers expect seamless, secure experiences, effective loyalty program fraud prevention is crucial; a single breach can undo years of relationship building.

To stay ahead, loyalty platforms must implement robust security measures, including transaction monitoring, machine learning, and security protocols such as multi-factor authentication, ensuring that only legitimate users can gain access to loyalty rewards.

Even small loyalty programs generate thousands of transactions and receipt uploads daily. Monitoring this data manually is time-consuming and error-prone, especially when fraud attempts are designed to blend in with legitimate behaviour.

When filters are too rigid, they often flag legitimate customers, leading to false positives, frustrated users, and damaged trust. Striking a balance between security and smooth user experience is increasingly difficult, especially with opportunistic customers trying to exploit weaknesses.

By the time traditional systems detect a problem, such as account takeover, rewards may already have been redeemed or data compromised. Without real-time monitoring, prevention becomes reaction.

That’s why brands are turning to AI-powered loyalty platforms, systems capable of learning, adapting, and defending automatically.

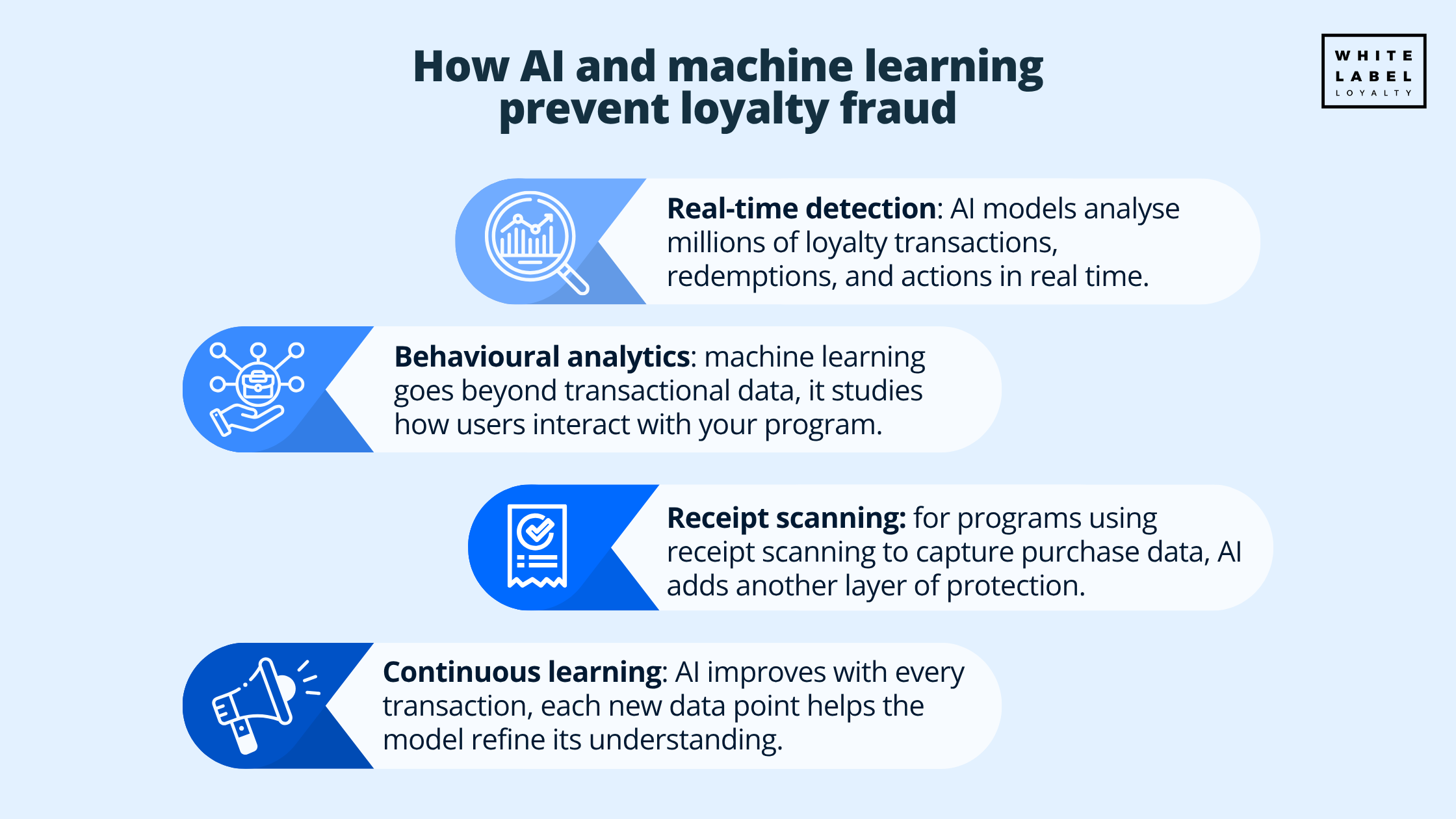

How AI and machine learning prevent loyalty fraud

Advanced fraud detection solutions are essential to protect against both internal fraud and external fraud while preserving the customer journey.

By analysing fraudulent behavior and identifying evolving fraud patterns, AI-powered loyalty platforms can flag suspicious activity in real time, preventing security breaches and maintaining brand reputation.

Brands should educate customers on secure account practices and manage access privileges carefully, reducing the risk that opportunistic customers or insider threats attempt to commit fraud and misuse the monetary value of reward points.

Here’s how advanced loyalty platforms, incorporating various types of loyalty, use AI to protect brands and their customers:

1. Real-time anomaly and suspicious activity detection

AI models analyse millions of loyalty transactions, redemptions, and actions in real time. They learn what “normal” looks like, typical purchase frequencies, point accrual rates, and redemption behaviours, then flag any activity that falls outside those patterns.

For example, a sudden spike in loyalty points earned from the same location, or multiple redemptions happening within seconds, can trigger instant alerts.

This allows fraud prevention teams to intervene before the fraud succeeds, protecting both customers and the integrity of the rewards system.

2. Behavioural analytics

Machine learning goes beyond transactional data. It studies how users interact with your program: login frequency, device type, time of day, and even purchase cadence for effective loyalty program fraud prevention.

By analysing these behaviours over time, AI can identify suspicious patterns, such as multiple accounts created from the same IP address or reward redemptions that don’t match a customer’s typical activity, thus reinforcing security protocols.

This behavioural layer makes it much harder for fraudsters to hide among genuine users, while ensuring legitimate customers enjoy a frictionless experience.

3. Image recognition for receipt validation

For programs using receipt scanning to capture purchase data, AI adds another layer of protection.

Machine vision models are trained to recognise duplicate uploads, altered dates, or manipulated totals, even when the image appears convincing to the human eye.

At White Label Loyalty, our receipt validation technology automatically flags irregular uploads for human review, combining machine precision with expert oversight.

This hybrid approach detected over 5,000 fraudulent receipts during PepsiCo’s promotional campaigns, protecting the brand and ensuring fair rewards for genuine customers.

4. Continuous learning for AI loyalty fraud detection

Unlike static rule systems, AI improves with every transaction. Each new data point, whether legitimate or fraudulent, helps the model refine its understanding of user behaviour.

As fraudsters change their tactics, the system evolves too, learning from emerging patterns across industries and geographies.

This adaptability makes AI a long-term safeguard, not just a short-term fix. It ensures your loyalty program stays secure, scalable, and one step ahead of potential threats.

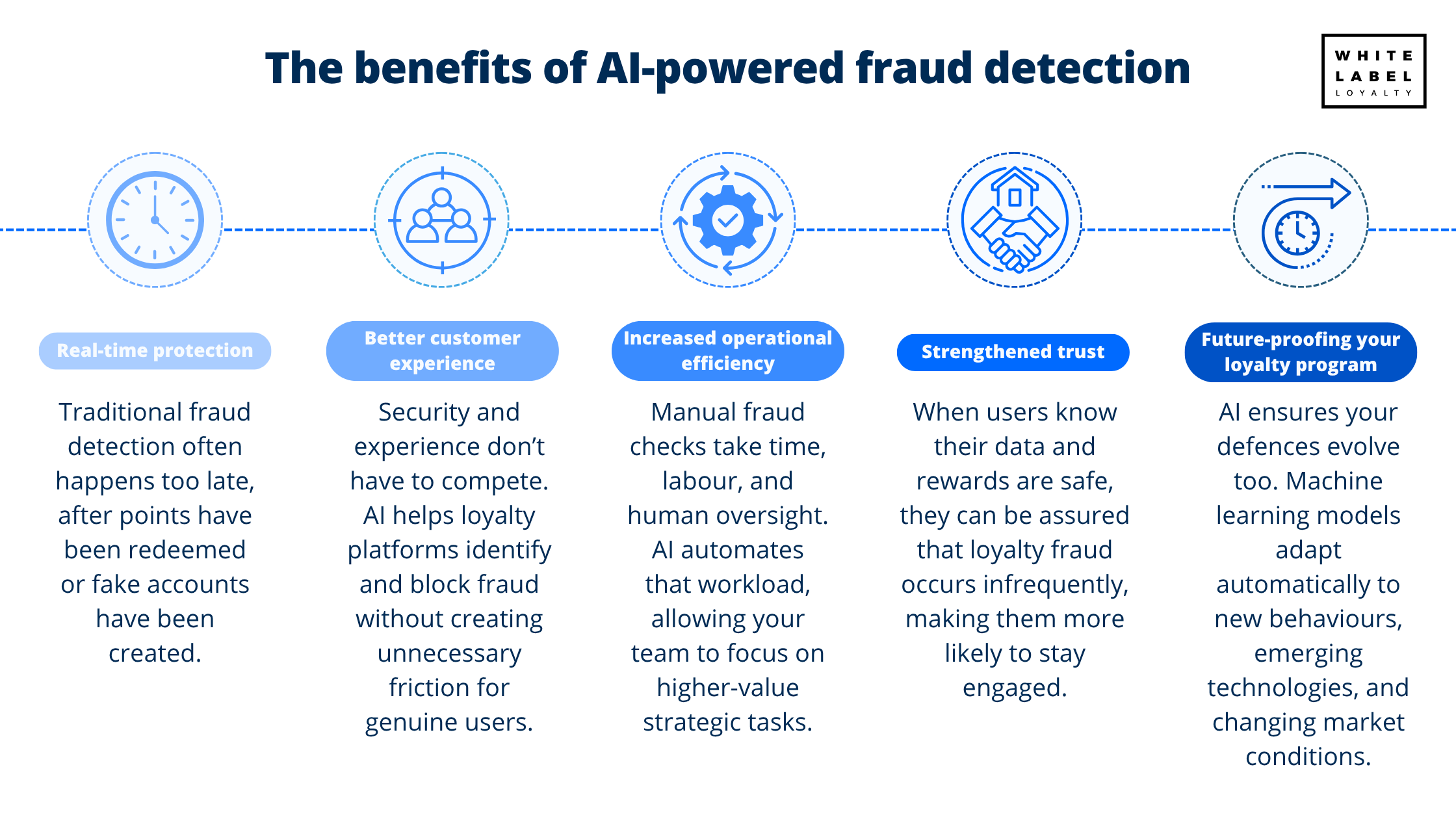

The benefits of AI-powered fraud detection

AI and machine learning make loyalty programs smarter, more efficient, and more rewarding for both brands and customers.

Here’s how intelligent loyalty fraud prevention technology delivers measurable benefits and security measures across every layer of your program.

1. Real-time protection that reduces security breaches

Traditional fraudulent activity detection often happens too late, after points have been redeemed or fake accounts have been created.

AI-powered systems work in real time, scanning transactions as they occur. That means unusual activity is flagged immediately, and fraudulent actions can be stopped before they cause financial or reputational damage.

This proactive approach turns your loyalty platform from a passive data collector into an active line of defence.

💡 Real-time detection = real-time protection. Every second saved reduces potential losses.

2. Better customer experience & customer loyalty

Security and experience don’t have to compete. AI helps loyalty platforms identify and block fraud without creating unnecessary friction for genuine users.

Because the system learns behavioural norms, it can reduce false positives, meaning fewer legitimate transactions are interrupted or delayed.

The result: customers enjoy a seamless experience while you maintain airtight security in the background and increase brand reputation.

3. Increased operational efficiency

Manual fraud checks take time, labour, and human oversight. AI automates that workload, allowing your team to focus on higher-value strategic tasks.

With intelligent monitoring, you can manage large-scale campaigns, thousands of transactions and receipt uploads, without expanding your prevention resources.

This translates into lower operational costs and a faster return on investment from your loyalty initiatives.

4. Strengthened trust and brand integrity

Trust is at the core of customer loyalty. When users know their data and rewards are safe, they can be assured that loyalty fraud occurs infrequently, making them more likely to stay engaged and recommend your brand.

AI-driven fraud prevention builds that trust by ensuring your loyalty program operates fairly and transparently.

Customers see a brand that takes security seriously, and that credibility becomes part of your value proposition.

5. Future-proofing your loyalty program

Fraud tactics will continue to evolve: AI ensures your defences evolve too. Machine learning models adapt automatically to new behaviours, emerging technologies, and changing market conditions.

By integrating AI-based monitoring now, you’re not just preventing today’s threats for enterprise brands: you’re future-proofing your loyalty ecosystem against whatever comes next.

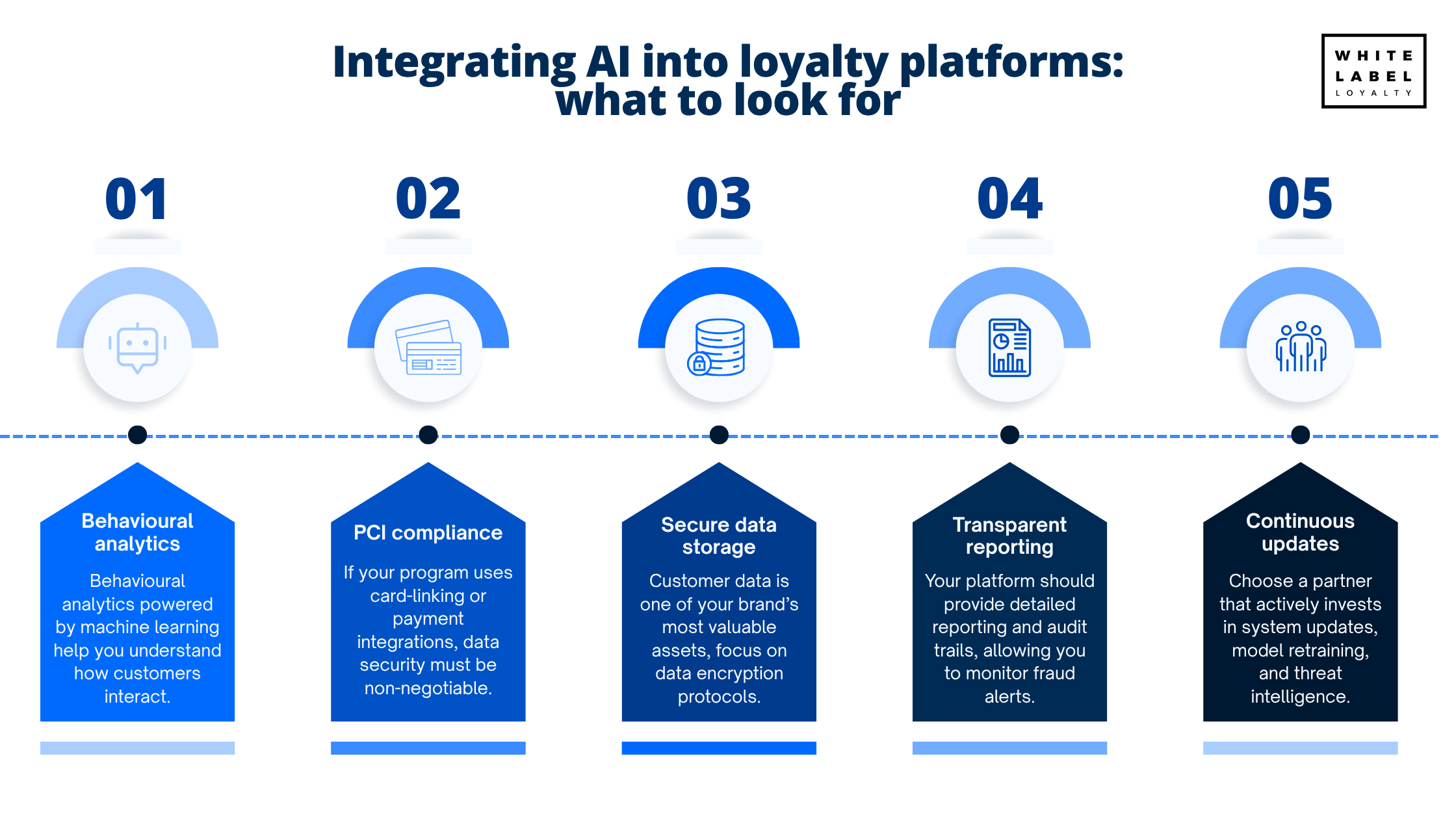

Integrating AI into loyalty platforms: what to look for

Adopting AI-driven fraud detection is all about building a secure foundation for long-term loyalty success.

When choosing a loyalty platform or technology provider, there are a few key capabilities and safeguards that make all the difference. Here’s what to look for:

1. Behavioural analytics and predictive insights

Behavioural analytics powered by machine learning help you understand how genuine customers interact with your program, and, just as importantly, when something feels “off.”

This kind of proactive intelligence allows brands to stay a step ahead of evolving fraud tactics, even as patterns change over time.

2. PCI compliance and card tokenisation

If your program uses card-linking or payment integrations, data security must be non-negotiable. Ensure your provider adheres to PCI DSS compliance standards and uses tokenisation to protect sensitive payment data.

This approach ensures that neither your business nor your loyal customers ever handle unencrypted card information, significantly reducing your risk exposure.

3. Secure data storage and encryption

Customer data is one of your brand’s most valuable assets. Ask your technology partner about their data encryption protocols, access control policies, and storage infrastructure.

Leading loyalty platforms store and process data within secure, GDPR-compliant environments, ensuring every transaction and record remains private and tamper-proof.

4. Transparent reporting and audit capabilities

Your platform should provide detailed reporting and audit trails, allowing you to monitor fraud alerts, resolution times, suspicious transactions, and security performance metrics.

With clear visibility, you can continuously optimise your fraud prevention strategy and demonstrate accountability to both stakeholders and customers.

5. Continuous updates for loyalty program members

Fraud prevention technology shouldn’t stand still. Choose a partner that actively invests in system updates, model retraining, and threat intelligence.

The best loyalty providers don’t just implement AI once, they evolve it continuously to address new challenges and fraud behaviours.

At White Label Loyalty, our platform is built with these principles in mind. From real-time monitoring and AI-based receipt validation to PCI compliance and tokenised security, our system ensures your program remains resilient, no matter how fraud tactics evolve.

Frequently Asked Questions (FAQs)

How does AI detect loyalty fraud?

AI analyses patterns in transactions, redemptions, logins, and receipt uploads to identify anomalies in real time, preventing unauthorized activity before rewards are claimed.

What types of loyalty fraud can AI prevent?

AI can stop account takeovers, fraudulent transactions, fake accounts, referral collusion, receipt manipulation, and coupon abuse.

Can AI reduce false positives for genuine customers?

Yes. Machine learning understands normal behaviour, allowing legitimate transactions to proceed smoothly while blocking suspicious activity.

Why is continuous learning important when it comes to loyalty fraud?

Fraud tactics evolve. AI systems that learn from each transaction remain effective against new threats and secure loyalty programs long-term.

The future of trust in loyalty

AI and machine learning enable brands to see loyalty through a new lens, one powered by data, driven by intelligence, and grounded in proactive protection. With every fraudulent attempt detected, every anomaly prevented involving customer accounts, brands reinforce a deeper message: our customers’ trust is our most valuable asset.

By embracing AI-driven fraud prevention, forward-thinking organisations can turn technology into a guardian of trust, and ensure that every point earned, every tier reached, and every reward redeemed continues to mean something real.

💡 At White Label Loyalty, we help brands protect what matters most: customer trust. Our platform uses AI-powered event tracking and machine learning models to detect and prevent loyalty fraud before it happens, ensuring your programme stays secure, transparent, and rewarding.

Get in touch with our loyalty experts and learn how our technology safeguards your loyalty ecosystem.

Recommended Posts

If you enjoyed this article, check out these relevant posts below.

Share this Article

Sara Rabolini

Content Marketing Executive

Sara is our Content Marketing Executive. She shares engaging and informative content, helping businesses stay up-to-date with the latest trends and best practices in loyalty...