Loyalty Programs in North Africa: Trends & Best Practices

North Africa is fast emerging as one of the most promising frontiers for loyalty and customer retention programs. With rapid digital adoption, growing mobile-money and e-commerce penetration, and an increasingly value-driven consumer base, the region has all the ingredients to transform how brands engage customers.

For companies looking to scale loyalty beyond traditional markets in Europe or the rest of the world, there’s never been a better time to look north.

In this post, we walk you through the key trends, market data, successful loyalty models, and actionable best practices, so you can assess how your brand could leverage loyalty programs in North Africa.

Why North Africa is prime for loyalty growth

The broader Africa loyalty market is projected to grow significantly, according to research: for 2025, estimates forecast ~ US$852.4 million, with double-digit annual growth and continued expansion through 2029.

Several structural, contextual, and local culture factors make North African countries especially fertile ground for loyalty programs:

- Digital payments and mobile wallets are on the rise: as financial and banking infrastructures evolve, mobile-first payment and wallet solutions are fast becoming mainstream. This transition lowers the barrier for launching digital loyalty programs at scale.

- Consumers are highly value-driven: rather than seeking status or luxury perks, many customers show strong interest in immediate value like discounts, cashback, and everyday savings.

- Competitive retail, telco, and fintech landscapes: rising competition across sectors pushes brands to differentiate via customer retention strategies. Loyalty becomes a key differentiator.

- Regulatory and infrastructural shifts: increasing digitization across economies in the region supports e-commerce, mobile payments, and fintech, enabling smoother loyalty program rollout and adoption.

Together, these elements make loyalty not just a “nice-to-have,” but a strategic lever for growth, especially for brands operating at scale or across multiple countries.

Best practices for brands launching loyalty in North Africa

If you’re considering launching or refining a loyalty program for Africa and the Middle East, these are the strategic takeaways you need to know to succeed:

- Go digital-first, prioritise mobile apps, wallets, and digital distribution over physical cards or paper vouchers. This aligns with adoption patterns and reduces friction.

- Offer high-perceived-value rewards: cashback, discounts, mobile credit, everyday savings. Avoid over-investing in status-based tiers or low-tangible-value perks.

- Leverage existing infrastructures: partner with telcos, fintechs or wallet providers where possible. This gives access to wide user bases and existing payment networks.

- Localise communication & rewards: adapt to language, culture, seasonal patterns (holidays, Ramadan, back-to-school), and consumer behaviour.

- Use event-based loyalty triggers and gamification: encourage repeat purchases, referrals, or frequent engagement with challenges, streaks, or seasonal campaigns.

- Ensure simple & near-instant redemption: digital rewards, wallet credit, and in-app vouchers work better than physical gifts or complex redemption flows.

- Track key KPIs diligently: measure adoption rate, activation rate, redemption rate, incremental revenue lift among members, churn rate, repeat purchase frequency, and ROI per member.

Top loyalty programs in North Africa & what makes them work

North Africa’s loyalty is driven by mobile-first consumers, rising digital payments, and strong retail and telco ecosystems.

The most successful programs and local businesses share a common thread: they meet customers where they already spend time and money, and they deliver value that feels immediate, tangible, and culturally relevant.

Below is a look at the region’s standout loyalty programs and the specific mechanics that make each a powerful tool for this and the MENA region.

1. Vodafone Shokran (Egypt)

What it is: A telecom-led loyalty program where customers earn points or rewards that can be converted into mobile credit or wallet balance (via the mobile-money or wallet services associated with Vodafone).

Why it works:

- Built on existing usage habits: Since most customers already use the telco regularly (calls, data, recharges), loyalty becomes part of everyday behaviour, no extra app for “just loyalty.”

- Low friction redemption: Rewards convert into mobile credit or wallet balance, frictionless and immediately valuable to the user.

- High reach & frequency: Telecom has mass penetration and frequent transactions, so program adoption and engagement tend to scale faster.

2. Carrefour MyCLUB (Egypt & Mena region)

What it is: The loyalty program of a major retail/grocery chain, offering points, discounts, or special offers to members when they shop in-store or online at Carrefour.

Why it works:

- Frequent, repeatable purchases: Groceries and household goods are bought regularly, ideal for loyalty points or cashback to accumulate fast.

- Strong value perception: Customers appreciate savings, discounts, or integrated cash-back, which notably gives a tangible benefit every time they shop.

- Brand trust & widespread presence: As a large supermarket chain, Carrefour is already a trusted brand; loyalty lowers barrier to enrolment and encourages retention.

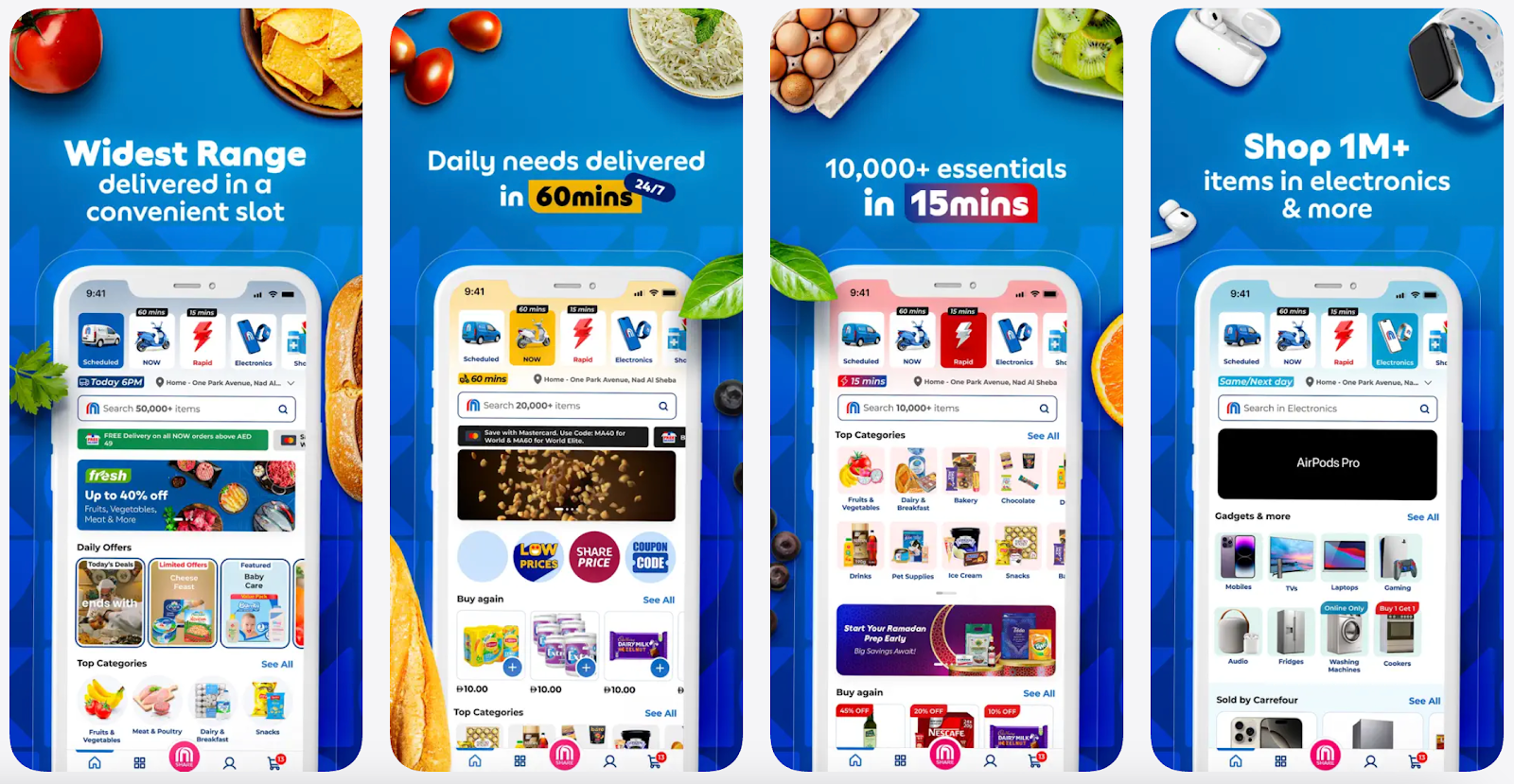

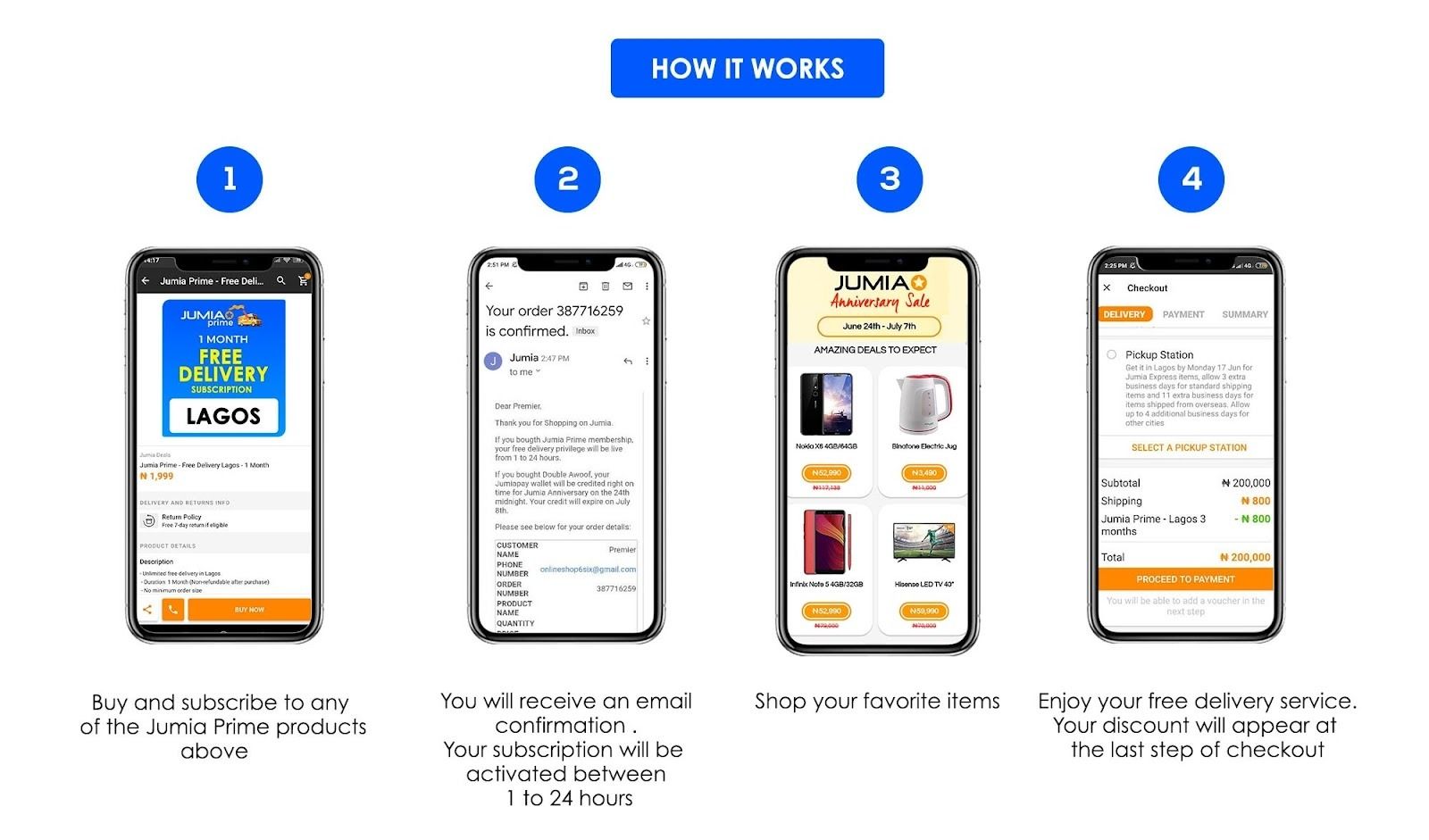

3. Jumia Prime (Egypt, Morocco, Tunisia, Nigeria)

Jumia Prime is a subscription-based loyalty program offering unlimited free shipping, exclusive deals, and faster delivery for members across Jumia’s e-commerce platform.

Why it works:

- Solves a major friction point: Shipping costs are a big barrier in emerging e-commerce markets and retailers; unlimited free delivery creates an immediate value spike.

- High perceived value: Even occasional online shoppers quickly “get their money’s worth,” improving retention.

- Adds predictability to e-commerce: Subscription loyalty stabilises monthly revenue while increasing repeat purchases.

4. Orange Merci Program (Egypt, Morocco, Tunisia)

Orange's loyalty program rewards customers for recharges, bill payments, app usage, and tenure. Customers redeem points for data, minutes, devices, or discounts with partners.

Why it works:

- Multi-touchpoint earning: Users accumulate points simply by doing normal telco interactions, paying bills, topping up, using the app.

- Tiered benefits without complexity: Offers bronze/silver/gold structures that feel rewarding but remain simple enough for mass audiences.

- Strong cross-industry partnerships: Device discounts, partner offers and bundles make it feel bigger than a “telco program.”

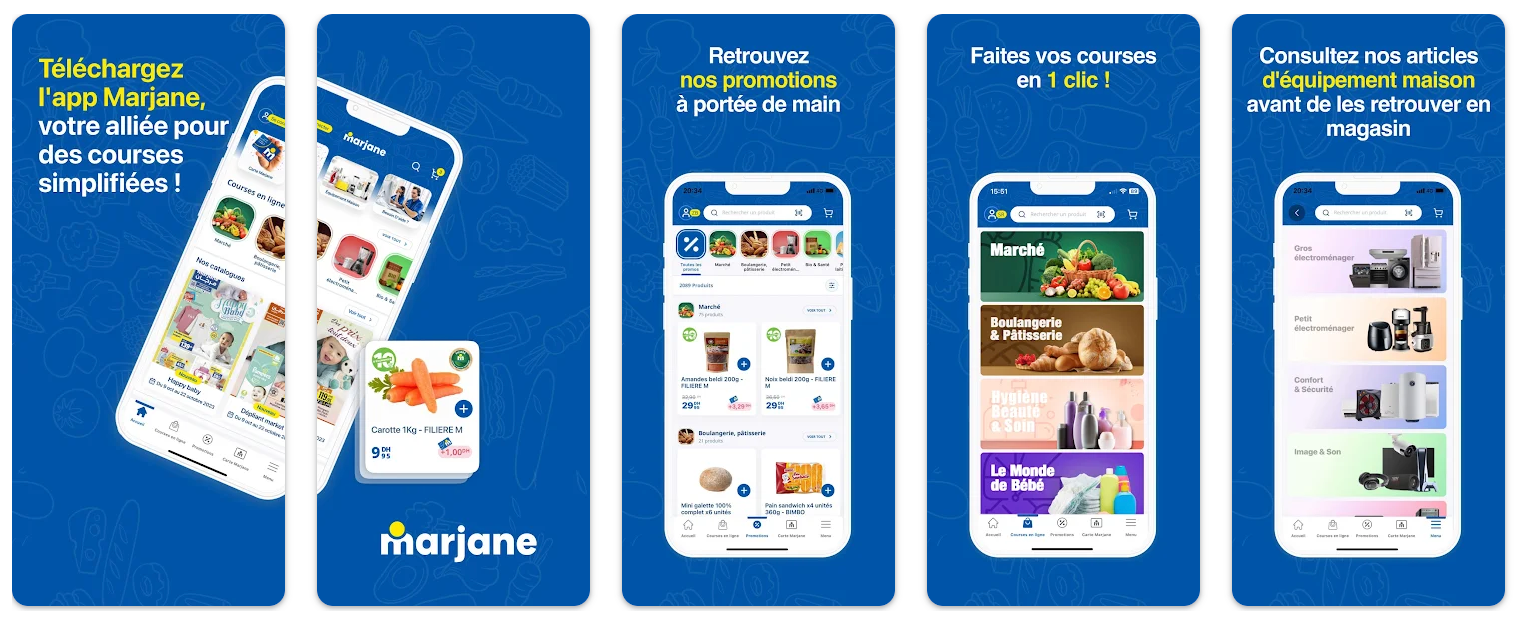

5. Marjane Loyalty Program (Morocco)

Marjane, Morocco’s largest hypermarket chain, runs a loyalty system where shoppers earn digital points and receive personalised promotions via app and SMS.

Why it works:

- Personalised offers drive basket size: The program leverages purchase history to send promos targeted to each household’s spending patterns.

- Strong presence = frequent earning: Marjane has national coverage, making the loyalty experience consistent and predictable.

- Local-first relevance: Offers and rewards reflect local needs and pricing realities, unlike imported loyalty models.

6. BIAT Loyalty (Tunisia)

BIAT, one of Tunisia’s biggest banks, offers loyalty points for using debit/credit cards, online banking, and merchant payments. Points convert into gifts, electronics, vouchers, or discounts.

Why it works:

- Rewards everyday financial behaviour: Card payments, withdrawals and bank transfers are rewarded, encouraging digital banking in cash-heavy markets.

- Diverse redemption catalogue: Rewards range from electronics to travel to local vouchers, appealing to a broad demographic.

- Supports digital adoption: Encourages consumers to shift from cash to digital, aligning with national financial-inclusion goals.

Conclusion

North Africa represents a rising frontier for loyalty and customer retention. With growing digital payments, high mobile penetration, and value-conscious consumers, the region combines favourable market conditions with high-growth potential.

For brands that design their identity and loyalty with simplicity, relevance, and flexibility, combining mobile-first distribution, high-value rewards, and data-driven personalisation, there’s a real chance to build relationships that go beyond one-time purchases.

As loyalty evolves globally, what matters most is not just points or tiers, but value, convenience, and trust. And in this continent, that’s exactly what consumers are looking for.

Get in touch with our loyalty experts today!

Recommended Posts

If you enjoyed this article, check out these relevant posts below.

Share this Article

Sara Rabolini

Content Marketing Executive

Sara is our Content Marketing Executive. She shares engaging and informative content, helping businesses stay up-to-date with the latest trends and best practices in loyalty...